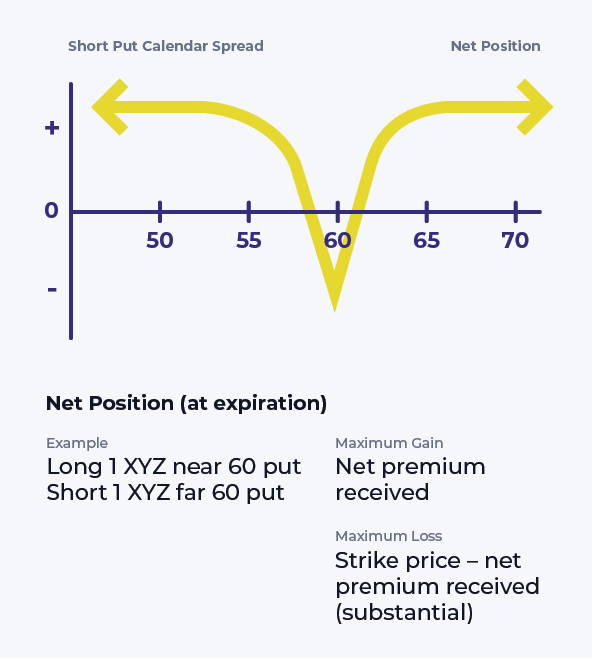

Short Put Calendar Spread - Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with calls and puts. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. A short put spread obligates you to buy the stock at strike price b if. Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. The options strategies » short put spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Short Put Calendar Spread Options Strategy

A short put spread obligates you to buy the stock at strike price b if. Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. The.

Long Calendar Spreads Unofficed

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. A short put spread obligates you to buy the stock at strike price b if. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the..

Credit Spread Options Strategies (Visuals and Examples) projectfinance

The options strategies » short put spread. In a short calendar spread, there are two positions with the same strike price:. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

A short put spread obligates you to buy the stock at strike price b if. In a short calendar spread, there are two positions with the same strike price:. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web a short put.

Using Calendar Trading and Spread Option Strategies

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. A short put spread obligates you to buy the stock at strike price b if. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near.

Long Call Calendar Spread Printable Calendar

Web a short put calendar spread is another type of spread that uses two different put options. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. A short put spread obligates you to buy the stock at strike price b if. In a.

Stock Secondary Offering Calendar STOCROT

The options strategies » short put spread. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short calendar spread with calls and.

Short Put Calendar Short put calendar Spread Reverse Calendar Spread Option Strategy YouTube

Web short calendar spread with calls and puts. The options strategies » short put spread. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short..

Glossary Archive Tackle Trading

In a short calendar spread, there are two positions with the same strike price:. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. A.

Calendar Spread Explained InvestingFuse

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar spread with calls and puts. A short put spread obligates you to buy the stock at strike price b if. Web the short calendar put spread is used to try and profit when you are expecting a security to.

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. The options strategies » short put spread. In a short calendar spread, there are two positions with the same strike price:. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't. A short put spread obligates you to buy the stock at strike price b if. Web short calendar spread with calls and puts. Web a short put calendar spread is another type of spread that uses two different put options.

Web A Short Calendar Spread With Puts Realizes Its Maximum Profit If The Stock Price Is Either Far Above Or Far Below The Strike Price On The.

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short calendar spread with calls and puts. The options strategies » short put spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Web The Short Calendar Put Spread Is Used To Try And Profit When You Are Expecting A Security To Move Significantly In Price, But It Isn't.

Web a short put calendar spread is another type of spread that uses two different put options. In a short calendar spread, there are two positions with the same strike price:. A short put spread obligates you to buy the stock at strike price b if.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)