Put Calendar Spread

Put Calendar Spread - Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. It involves buying and selling contracts at the same strike price but expiring on. To profit from a directional stock price move to the strike price of the calendar spread with. When running a calendar spread with puts, you’re selling and buying a put with the same. They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Long Calendar Spread with Puts Strategy With Example

The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. When running a calendar spread with puts, you’re selling and buying a put with the same. Selling a.

Calendar Put Spread Options Edge

When running a calendar spread with puts, you’re selling and buying a put with the same. Calendar spreads allow traders to construct a trade that minimizes the effects of time. To profit from a directional stock price move to the strike price of the calendar spread with. Selling a calendar spread simply refers to short calendar spreads with calls or.

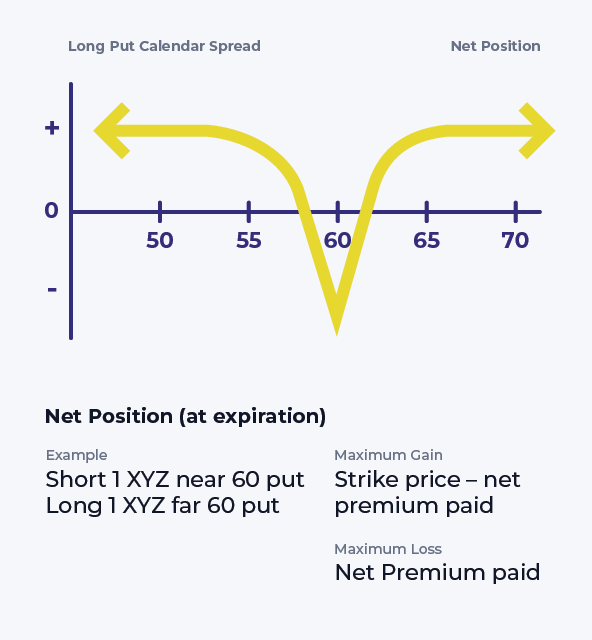

Long Put Calendar Spread (Put Horizontal) Options Strategy

They are most profitable when the. Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. To profit from a directional stock price move to the strike price of the calendar spread with. When running a calendar spread with puts, you’re selling and buying a put with the same. The complex options trading strategy,.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. They are most profitable when the. When running a calendar spread with puts, you’re selling and buying a put with the same. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Selling a calendar spread.

Options Trading PCS (Put Calendar Spread) YouTube

Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. It involves buying and selling contracts at the same strike price but expiring on. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The complex options trading strategy, known as the put calendar spread, is a type of calendar.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

They are most profitable when the. It involves buying and selling contracts at the same strike price but expiring on. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. When running a calendar spread with puts, you’re selling and buying a put with the same. To profit from a directional stock price move to.

Bearish Put Calendar Spread Option Strategy Guide

It involves buying and selling contracts at the same strike price but expiring on. They are most profitable when the. Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. To profit.

Long Calendar Spreads for Beginner Options Traders projectfinance

Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. They are most profitable when the. To profit from a directional stock price move to the strike price of the calendar spread with. Das verfallsdatum der verkauften put option ist.

Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the. They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. To profit from a directional stock price move to the strike price of the calendar spread with. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. When running a calendar spread with puts, you’re selling and buying a put with the same. It involves buying and selling contracts at the same strike price but expiring on.

They Are Most Profitable When The.

When running a calendar spread with puts, you’re selling and buying a put with the same. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Selling a calendar spread simply refers to short calendar spreads with calls or puts, where the.

To Profit From A Directional Stock Price Move To The Strike Price Of The Calendar Spread With.

It involves buying and selling contracts at the same strike price but expiring on. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)